COVID-19: Three Nos in impairment assessment

The COVID-19 outbreak in December 2019, which is now a global pandemic, has affected more than 200 countries and territories and caused immense uncertainty around the world.

The direct impact of the pandemic and the string of counter-measures from governments, be they the record-breaking scale of economic stimulus packages, or movement control orders that are aimed to contain the pandemic, have inevitably affected social and economic behaviour on a global scale. The social and economic impacts are evident from the drastic rise in unemployment across the world, and the first GDP contraction in decades for many countries across the globe. Despite the discovery of a potential vaccine, the world is still in unchartered territory.

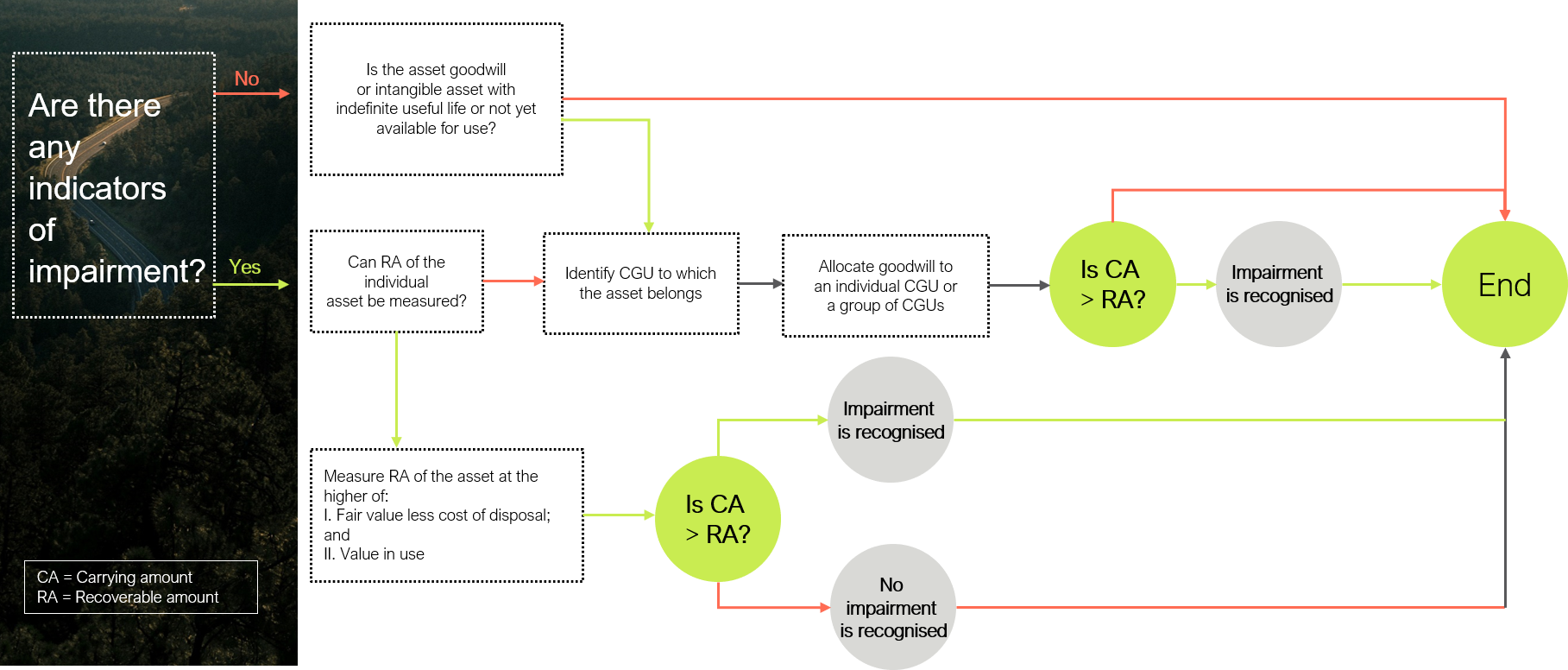

Against the backdrop of pandemic-induced market volatility and uncertainty, impairment assessment has become more crucial and challenging. There may well have been indicators of impairment in the 2020 interim reporting period that triggered a test of a company’s asset or a group of assets (a cash- generating unit or CGU), when conducting the annual impairment assessment, both on acquired goodwill and intangible assets with indefinite life, or not yet available for use (if any).

The standards require companies to consider, as a minimum, the following information from both external and internal sources to determine if an impairment assessment is required (please see the diagram below).

| External sources |

|---|

- Significant decline in the market value of an asset

- Significant adverse changes, whether current or in the near future, in market, technology, legal and economic environment where the company operates

- Increase in market interest rates

- Market capitalisation is lower than the carrying amount of the company’s total net assets

| Internal sources |

|---|

- Evidence of obsolescence or physical damage to an asset

- Significant changes in the market, whether current or in the near future, to which an asset is used e.g. asset becomes idle or plans to discontinue operations

- Internal reporting that indicates worse than expected economic performance of the asset

1. Impairment assessment is not always based on the worst-case scenario

When indicators are identified, companies are required to assess the recoverable amount of the asset or CGU as the higher of

- its “fair value less costs of disposal” and

- its “value in use” as of the reporting date.

The recoverable amount is estimated by using a set of future cash flows expected to be generated from the asset or CGU. It is all about the most likely outcomes based on reasonable and supportable assumptions as of the reporting date. Companies should not base an impairment assessment on the worst-case scenario as the objective is not to stress test the impairment assessment to the extreme.

2. Goodwill arising from a business combination should not be simply written down

Another key point to emphasise is the importance of recognising that a drop in a company’s market capitalisation may very well be short-term and may / may not change the core value of the company. Goodwill, as a result of synergy created from a business combination, should not be simply written down but a careful evaluation based on facts and circumstances is required.

In most cases, the synergy arising from the business combination is assumed to phase-in over a certain period of the discrete forecast and be capitalised in the perpetuity calculation (terminal year) through cost savings from operational efficiencies or revenue upside as a result of better asset turnover.

3.Do not double count the increased risk factors

The global pandemic may affect the cash generating ability of an asset or CGU due to the increase in risk and uncertainty. As a result, companies are advised to adjust either the future expected cash flows or discount rate to reflect the increased risk factors, but not both.

This requires a reasonable consideration and understanding of the operational and financial prospects of the asset or CGU in which it operates. It may also be necessary for companies to consider an entity-specific risk premium when estimating the cost of equity.

| Overall, impairment assessment is a key element of the financial reporting process. The process may be complex and time consuming. Therefore, it is vital that companies plan early and have proper business modelling and forecasting. Our experience in impairment assessments can help companies navigate through the impairment triggers and produce better impairment valuations. |

|---|

Feel free to download the full version in PDF.

Should you have any questions please feel free to contact our experts:

Krzysztof Horodko

Krzysztof Horodko

Managing Partner

Monika Tuzimek

Monika Tuzimek

Partner

Tomasz Manowiec

Tomasz Manowiec

Director, Corporate Finance